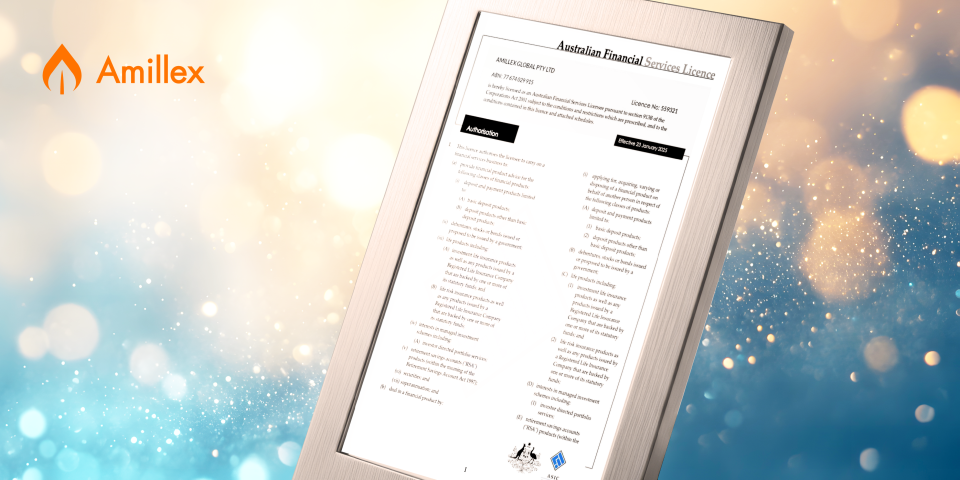

Amillex: USD 1.5 Million Professional Indemnity Insurance Comprehensively Builds a Client Fund Protection System

In the field of financial transactions, fund security is the cornerstone of trust. Amillex always prioritizes the protection of client assets, establishing a triple protection system of regulatory compliance, fund…